Stock Recommendation Buy Alert Example: Crocs

New York Stock Exchange (NYSE) Performance Year Over Year

“Beware of Alligators!” I hear that a lot living in Florida. Shoe companies across the world are also afraid of a similar reptile, but I’m not referring to crocodiles. I’m referring to Crocs, the shoe company. Crocs Inc. (CROX) is an American shoe brand that specializes in comfortable and casual footwear. They are taking market share all over the world. CROX prioritizes comfort and provides excellent value in price to their customers. Many of their customers are die-hard fans and once they purchase a pair, they’re highly likely to keep purchasing more down the road. I believe that the growth and overall strength of this company is misunderstood by the market and causing the stock price to be way undervalued. I do believe that this is a great business to buy and hold for the long run. Now, before continuing, I have a confession to make. When I was little my cousins had a pair of Crocs and oh did the family, (me included) tease them. I wouldn’t have been caught dead in a pair of Crocs. But how the tables turned. I am a believer in not only the shoe, but the company as well.

Strengths

CROX is the most profitable shoe company in America, and they are by a longshot. On top of that, CROX sells the cheapest amongst its peers using price-to-earnings (P/E). P/E is a way to value a company based upon how much money they make. Being profitable comes from many things; great management, controlling costs, low expenses, high sales. I want to talk about Croc’s ability to control costs because I think how they are designed gives them a huge advantage that many others will not be able to easily replicate.

Think about the design and materials needed for a Croc, compared to a tennis shoe, flip flop, or other sports slide. Crocs have an exceedingly small amount of different material used, which makes production easier, cheaper, and less likely for interruption. Companies that have many materials from various places are exposed to delays when 1 piece is missing. Less materials are better from a production standpoint. The main material in Crocs is called Croslite, a proprietary material. The main material in Croslite is EVA, which comes from crude oil. Crude oil is readily available everywhere because it’s frequently produced or imported, making Croc production easy. With Crocs you have Croslite, some dye, a metal button, and that’s pretty much it!

The shoe design meant to be worn loosely helps with profitability. They don’t do half sizes, nor do they do wide or thin sizes. The shoe is unisex and most of the sizes between men and women overlap. All these lead to Crocs needing less types of inventories. Machine changes are less frequent at factories because they aren’t required to recalibrate for every shoe size. This also leads to stores needing less shelf space to sell Crocs. The CROX stores that only sell the CROX brand, and nothing else, can operate with less square feet. This makes them more competitive on real estate prices because they can lease a smaller space. Next time you go to a store that sells shoes, try to look at how much space is taken by the same shoe because of the different size varieties they need (such as 10 men’s, 10.5 men’s, 11 men’s, 10.5 men’s wide etc.). Then double that for women’s sizes as well. This takes up a lot of space. If you’re Crocs, having less variety leads to better inventory management to make the shoe more profitable for themselves and the shoe store who sells them. A win-win!

The unique and easily identifiable design is a marketing campaign in itself. Ask someone wearing Crocs what they think, and they will probably tell you they would wear them for every occasion if they could. They are trending well with kids, teens, and young adults. I have a 2-year-old and I can see how having a shoe that is easy to put on, comfortable, and easy to clean is a must have. The Baader-Meinhof phenomenon, or frequency illusion, is when your brain adjusts to a particular item after you own it. For example, how you always see a type of car after you own it. I purchased a pair of Crocs and now I see them everywhere. At first, I thought it was just frequency illusion but it’s more than that. Every time a see a sporting event, I see athletes changing out of their cleats and putting on Crocs. Whenever I see a group of kids, many have colorful Crocs on their feet. The growth and customer loyalty of the brand is undeniable. They are climbing the rankings for favorite shoe amongst U.S. Teens at a rapid rate.

Comfort shoes aren’t anything new, but the look of Crocs is different to say the least. Whereas Nike has untold number of competitors going for athletic shoes, or reefs and adidas battling it out with dozens of others for the flip flop market. What other company is going to try to attack the “ugly half clog, half sandal” market and do it as well as Crocs. Good luck for those that try.

Growth + Value

I’d like to take a moment and draw some similarities that I see with the rise of Crocs and Nike. If you haven’t read the book about Phil Knight starting Nike, “Shoe Dog”, I highly recommend it. One big take away from the book is about capitalizing on style trends. When Nike was starting out, it wasn’t common for people to wear athletic shoes as a go-to shoe like they do today. It was seen as too casual. The combination of Nike taking market share in athletic shoes and athletic shoes taking market share in the shoe industry led to explosive growth of an iconic American brand. I am seeing many similarities with Crocs. The past couple of decades have seen a further rise in demand and openness to even more casual shoes. Comfort over everything has taken precedence when it comes to style and what to wear. Many critics of Crocs originally (hate to admit it but myself included) were skeptical of the shoe when they came out and considered them as just a fad. 20 years and 10s of billions of dollars of sales later, safe to say that is not the case.

It's great to see when a company is not only highly profitable but also has massive room to grow. This future growth leads to future sales, future earnings, and a continuously higher stock price in the future. Of course, just because there is a market available doesn’t mean you will automatically get it, but I feel confident that Crocs is up to the task. Currently, they make 60% of their sales in the Americas, but their international markets are growing quickly. Below are 2 charts. The first chart shows their revenue growth (in billions) and the 2nd chart shows the geographical makeup of their market and where the growth is in those markets. More growth, more sales, more money.

CROX has started to expand more into other unique brands that are similar. One example is HEYDUDE. In 2022, they acquired HEYDUDE (another comfort shoe company) for $2.5 billion. They did it with a combination of stock and cash (which they borrowed). They have a few short-term issues that are in the process of being addressed. The main issue is getting the 3rd party selling of HEYDUDE under control, mostly on Amazon. These unapproved sellers were selling at unapproved prices which can hurt a brand image. Most of that inventory has sold out and now they are more in control of the 3rd party sellers.

The company is making massive progress on using cash flow from the company to reduce the debt and buy back stock used in the transaction. In Q4 2023, they paid down $277 million in debt, and have paid down $665 million in debt for the whole year. They have repaid $1.2 billion of the $2 billion total debt amount needed for the HEYDUDE acquisition. This shows that one, they have massive cash flows that supported this acquisition, and two, that type of cashflow will support further growth. They also bought back $25 million of stock in Q4 of 2023. Stock buybacks is one of my more preferred ways of return of capital. If you’re new to Iron Bay Research or just need a reminder, read on about stock buybacks. This one can be a bit confusing, stay with me here. Imagine a pizza cut into 8 slices that are all the same size. Now imagine that same pizza, except it was cut into 7 slices. There is still the same amount of pizza overall, but each slice is bigger. That is what buybacks do, they make the pieces, or shares, bigger. A company issues stock to the public (when they become public and at other times throughout operations). The public can buy/sell these stocks and the number of shares outstanding is called the float. However, the company can also buy back these shares to reduce its float. Why would they do this? If each share gives the owner a claim to the earnings and dividends, then the smaller number of shares outstanding, the larger the earnings and dividends for each share. And if you weren’t bored enough with this explanation, buybacks are more tax advantageous than dividends.

Valuation + Conclusion

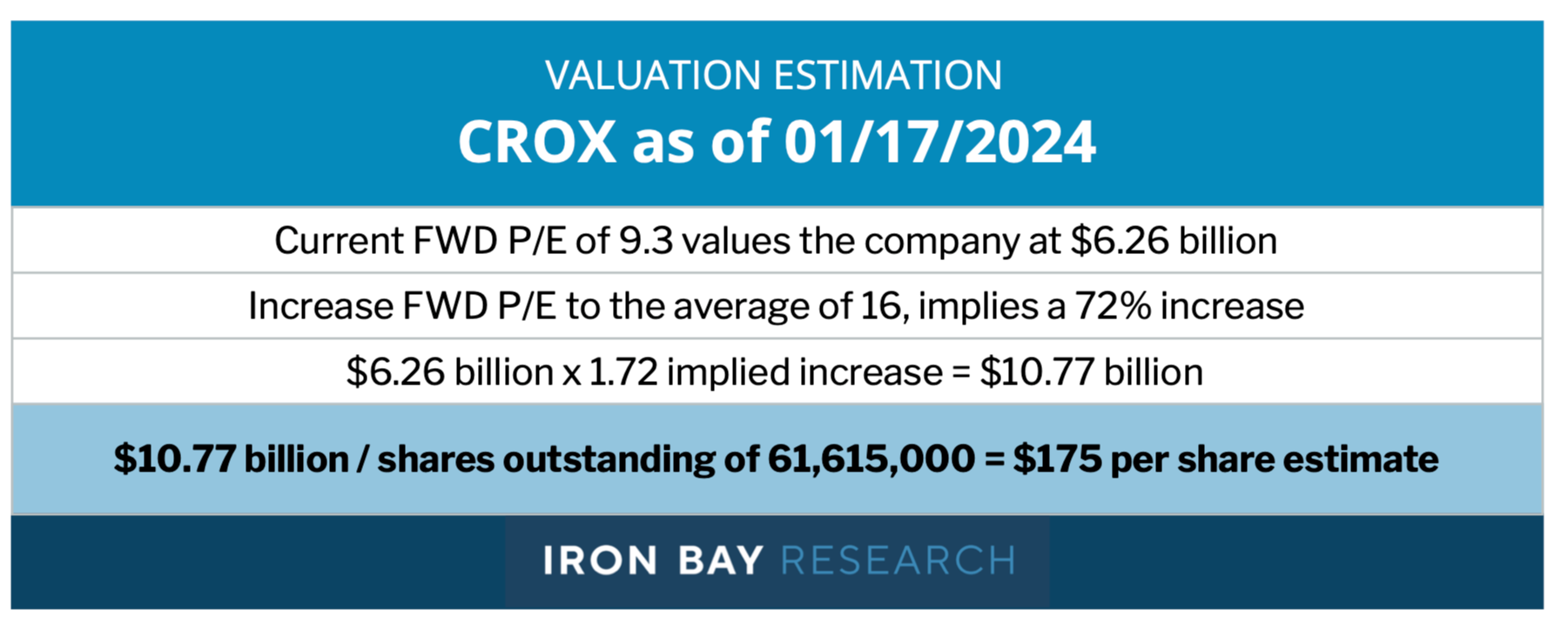

In its current state, I believe CROX is a perfect example of a growth company at a value price in regard to P/E. They are selling the cheapest comparatively in the shoe market. P/E (price to earnings) is a numerical ratio for the relationship between the company’s earnings and the stock price. Without getting into the weeds, low growth companies tend to have a lower P/E and high growth tends to have higher P/E. There are also several types of P/E valuations, and I will be using P/E on a forward basis, meaning the equation is accounting for the earnings that company should receive in the future i.e., forward. The fact that they are the most profitable regarding operating margins and have room to grow, makes this too good of an opportunity to pass up.

I do hesitate to put a price tag on the company’s future value just because it is changing rapidly. If sales continue at their current pace, CROX will have nearly a $1 billion in operating income every year from this point to either pay down debt, increase marketing, by back shares, or acquire something new. For a company that has a market cap (market cap is the value of the whole business) is just over $6.2 billion, that is a lot of firepower for improvement. They are trading at a forward P/E around 9.3. The forward P/E for the shoe sector is around 16. Again, a higher P/E means the company is more expensive (but not necessarily more valuable). Most of its peers are actually trading closer to 30, it’s CROX that is weighing down the median. Remember, they have higher profit margins than ALL of those peers and they have a growth track record that at least matches and, in many cases, has a higher growth than their peers. So being conservative, even if the forward P/E multiple increased to the median of 16, the stock is looking at a roughly 72% increase to $175 a share, which funny enough brings it right back to its peak price in November 2021. I do strongly believe that this company is changing so much year over year that the price estimate will vary widely, and this is a stock that is best to just buy and let grow for the long term.

To reiterate, this estimated valuation is based upon a lot of assumptions, including the guestimate that CROX will hit next years estimated numbers, or that CROX is not cheap on a FWD P/E, but that the sector median is expensive. Either way, there is enough margin of safety here to protect an investor from the downside and leave plenty of room for the upside. Remember, when you buy a stock, you become the owner of that business. So, when you buy some CROX stock, save a bit of money to get yourself a pair of their shoes. And if I haven’t convinced you to buy the stock, go buy a pair of Crocs to see for yourself. I’m sure you will come around.

Keep in mind…

At any given time, these reports will be recommending stock holdings of about 10 different stocks. So, for them to be equally weighed, 10% of your available funds per stock would be appropriate if you purchased all the recommendations. For example, if you have $10,000 set aside to invest, $1,000 would be the position size. This is not a set rule, more of a guideline. If you like one stock more than the other, feel free to add more to that position than 10%. This is your personal portfolio and maybe you pass up on a specific stock for personal reasons. Know, that after you buy a stock, there is always the possibility that it will GO DOWN. Your first instinct may be regret or want to sell. DON’T, patience is key. This is part of the process. If anything, you should see this as an opportunity to buy more stock at a cheaper price. What many investors (me included) do is “tranche” into a stock position. This is when you buy your full position in portions. For example, if you decided to purchase $1,000 of stock ABC, you could break it up into 2 purchases of $500. You could buy $500, then wait a few days to buy $500 more. This will give you the average purchase price of the aggregate and can help with some of the pressure in trying to get into a stock at the best possible price.

Important Disclosures: The information here is provided by Iron Bay LLC (“Iron Bay”) and: (1) is for general, informational purposes only; (2) is not tailored to the specific investment needs of any specific person or entity; and (3) should not be construed as investment advice. Iron Bay does not offer investment advisory services and is not an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”) or any other regulatory body. Any opinions expressed herein represent current opinions of Iron Bay only, and no representation is made with respect to the accuracy, completeness, or timeliness of the information herein. Iron Bay assumes no obligation to update or revise such information. In addition, certain information herein has been provided by and/or is based on third party sources, and, although Iron Bay believes this information to be reliable, Iron Bay has not independently verified such information and is not responsible for third-party errors. You should not assume that any investment discussed herein will be profitable or that any investment decisions in the future will be profitable. Investing in securities involves risk, including the possible loss of principal. Important Information: Past performance does not guarantee future results. This information is not a recommendation, or an offer to sell, or a solicitation of any offer to buy, an interest in any security, including an interest in any investment vehicle managed or advised by affiliates of Iron Bay. Any information that may be considered advice concerning a federal tax issue is not intended to be used, and cannot be used, for the purposes of (i) avoiding penalties imposed under the United States Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transaction or matter discussed herein.

Copyright (C) 2024 Iron Bay Research. All rights reserved.